What you need to know about the new CPD standards for financial advisers

In an effort to raise educational standards and improve trust and confidence in financial advisers, new CPD standards kicked in on 1 January 2019.

In part one of this two-part blog series, we aim to unravel and consolidate the plethora of information (and perhaps misinformation) flying around about changes to CPD for financial advisers. If you think it’s a minefield, read on and let us help you plan your next move.

The Why, What and When

The why…

You’d have to have been living in a bubble not to be aware of the new educational standards being introduced for financial advisers, or at least have come across some of the arguments for and against. Headlines have abounded over the past two years. The recent Banking Royal Commission provided plenty of fodder and intensified the impetus to improve the ethics and professionalism of the industry – in the hopes that it can build trust and create better consumer perception of financial advisers.

The upshot of all this argy-bargy was that the Corporations Act now states that all ‘relevant providers’ (and yes, if you’re reading this, that’s probably you), will need to meet CPD requirements as set down by the Standards Body, the Financial Adviser Standards and Ethics Authority (FASEA). This means one set of rules for all. Seems sensible, right?

So, who’s FASEA?

FASEA was mandated back in April 2017 to set the education, training and ethical standards for licensed financial advisers in Australia. So, basically they’ve written the standards that all financial advisers will now live and die by, including those around CPD.

The CPD requirements are underpinned by Standard 10 in FASEA’s new Code of Ethics: You must develop, maintain and apply a high level of relevant knowledge and skills.

The what…

FASEA’s CPD policy is made up of two parts – responsibilities and requirements – but let’s just concentrate on the important bits.

The humdrum (responsibilities)

For individuals this means:

- developing a CPD plan

- completing at least 40 hours of CPD in each CPD year

- maintaining a record of completed CPD (to be kept for seven years)

- providing records of your CPD to your licensee.

For financial services licensees this means:

- supporting your authorised reps, employees and relevant providers (your cohort) to maintain an appropriate level of competence

- ensuring you’re satisfied that the knowledge and skills of your cohort are up to date

- maintaining and publishing a CPD policy to be adhered to by your cohort.

The nitty-gritty (requirements)

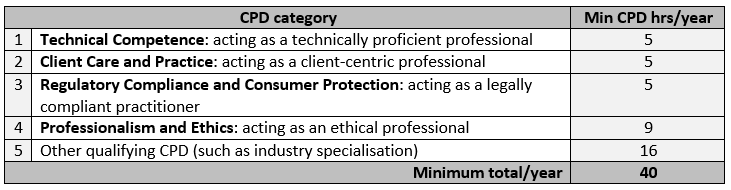

Your new CPD requirements will be based on categories and hours, best shown in this table:

The when…

There’s no doubt it’s time to get your ducks lined up as the new rules took effect from 1 January 2019, so the transition period is already underway.

The key date to diarise is 31 March 2019 as this is when licensees must have:

- published a licensee CPD policy

- approved CPD plans for each relevant provider, regardless of the commencement of the CPD year.

The CPD year

If your CPD year started after 1 January 2019, you’ll need to pro-rata your CPD hours for the period from 1 January to the commencement of your CPD year. These hours then get added to your first full CPD year.

Example:

- Jim’s CPD year commences on 1 July 2019

- Jim must complete 20 pro-rata hours of CPD to cover the 1 January 2019 – 30 June 2019 period

- Jim must complete 40 hours in his first full year (1 July 2019 – 30 June 2020)

- Jim’s CPD plan will need to include a total of 60 hours of CPD by 30 June 2020

While the new standard might appear onerous, remember that CPD is a valuable tool that keeps everyone up to speed and builds organisational capability. If you keep your focus on high quality, fit-for-purpose training, you really can’t go wrong.

Our next post in this series – How to get your CPD house in order – will look at how to prepare your organisation for compliance and what you should look for in a training solution.

Seize the opportunity! Use this period of change to reassess your training needs and find a solution that’s right for you. For more information and to discuss your organisation’s learning needs, contact us today.

About the author

Donna Ewing

Senior Instructional Designer

You might also like

HRWorkplace ethicsLMSMicrolearningVirtual teamseLearning contentGamified learningWorkplace learningOnboardingInstructional designCoronavirusWHSOnline learningComplianceContent development

Compliance Training Essentials: A Guide to Effective Content That Minimises Risk for Your Organisation [eBook]

Want to learn more about our tailored solutions?

Chat to one of our assessment or learning consultants today.

or call us on 1300 857 687 (Australia) or +61 2 6652 9850 (International)